Role: UX/UI, Product Strategy, Art Direction

Credits: TransUnion Interactive - 2018

Overview

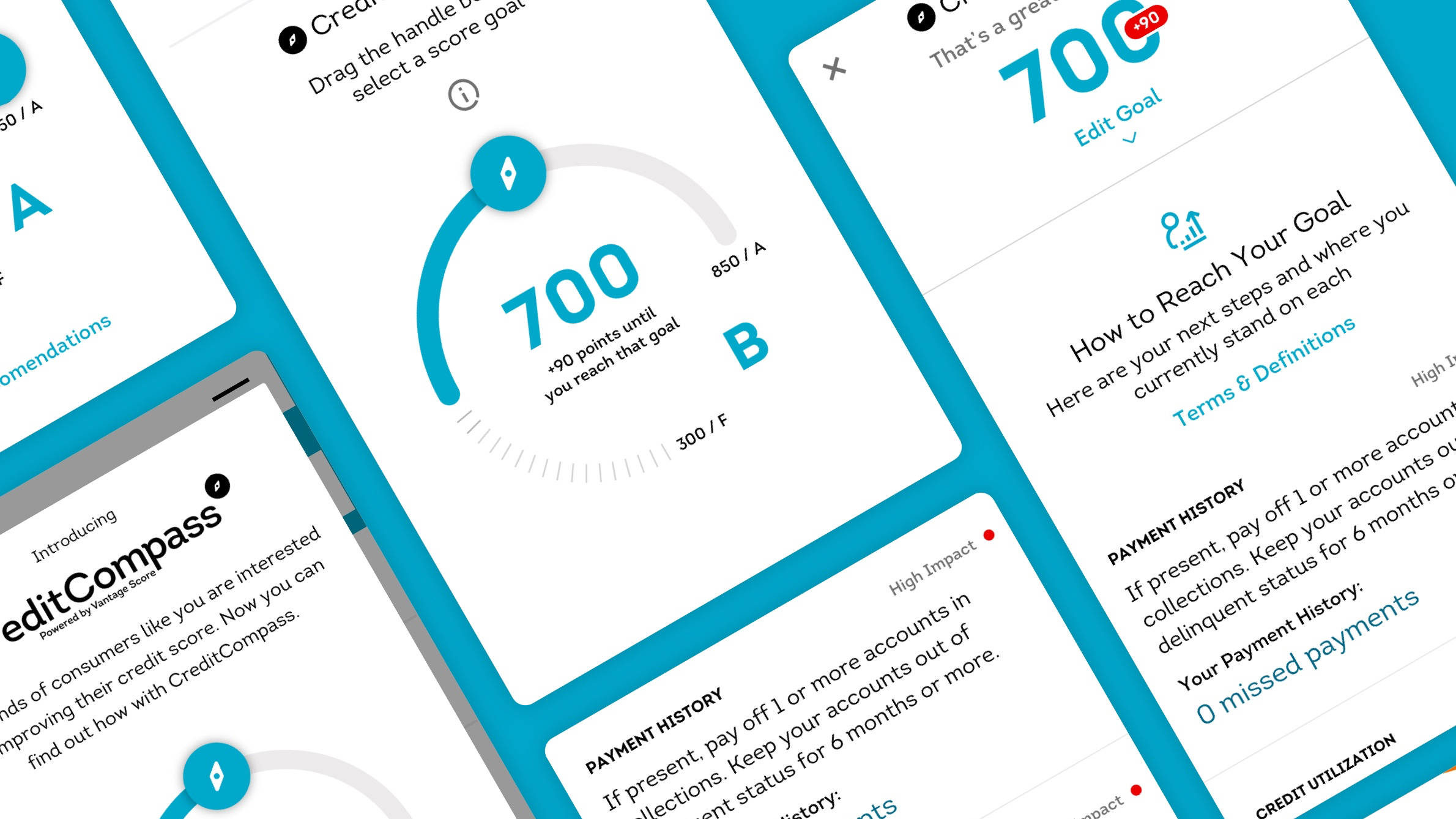

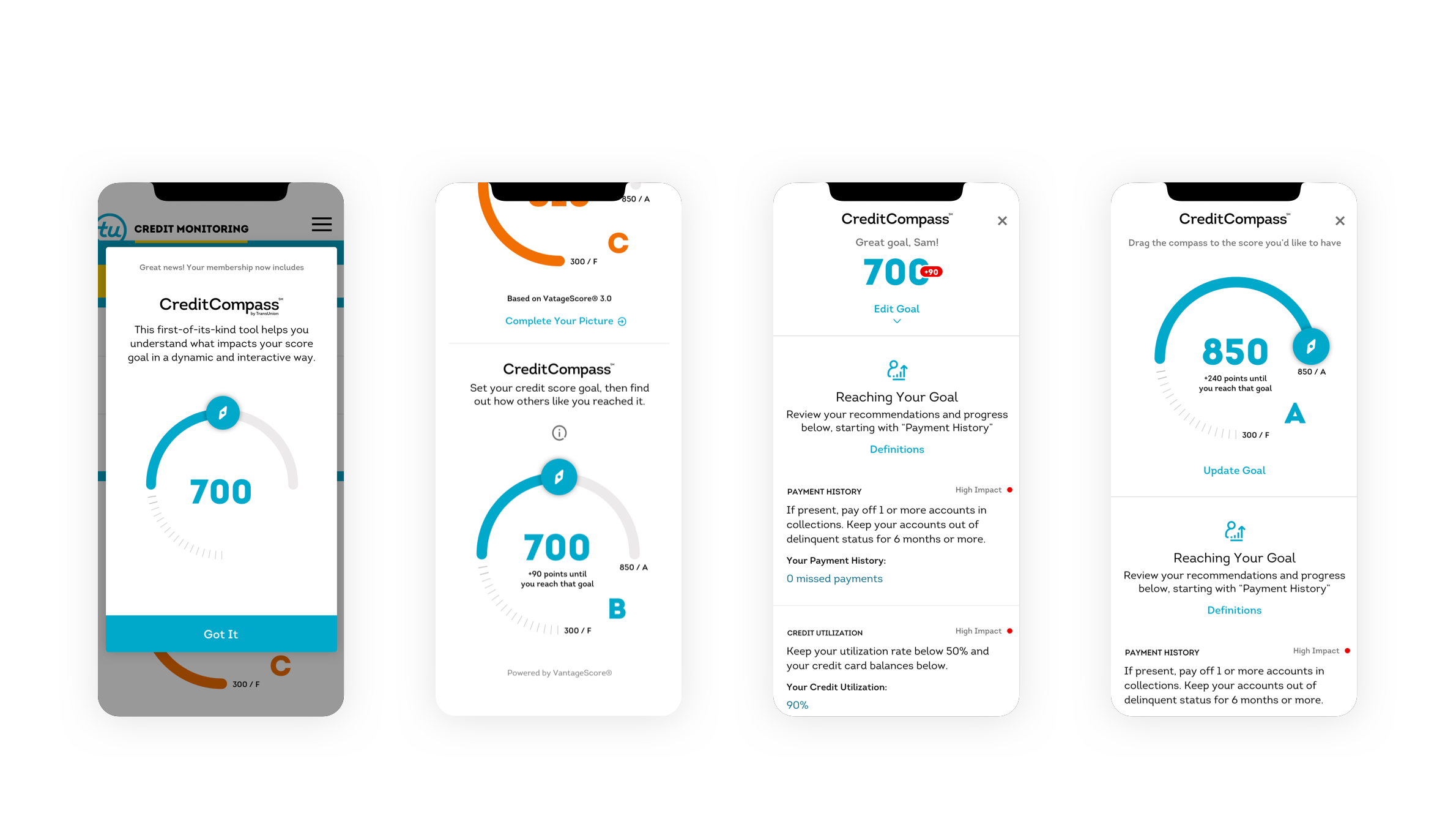

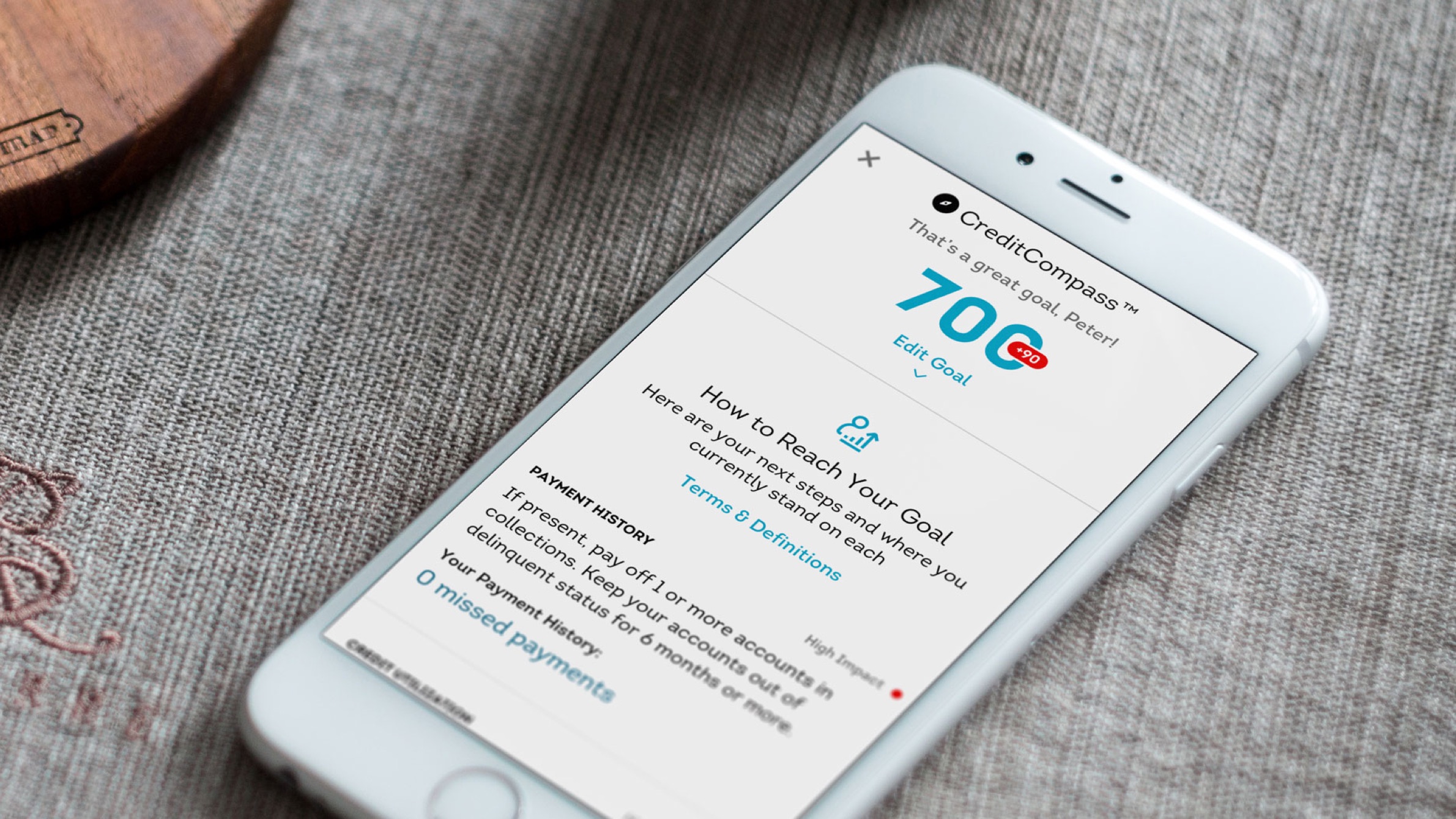

Credit Compass is a first-to-market product that allows users to interact with their credit score and set personalized credit goals. Once a user sets a goal, they will receive credit 'tips' about how to reach that goal based on data collected over a two year period from our user base. They will see where they are currently in each category and how to improve to reach the next milestone in their credit goals.

Credit Compass is a first-to-market product that allows users to interact with their credit score and set personalized credit goals. Once a user sets a goal, they will receive credit 'tips' about how to reach that goal based on data collected over a two year period from our user base. They will see where they are currently in each category and how to improve to reach the next milestone in their credit goals.

Problem

Data reports that consumers still feel lost when it comes to improving their credit score. Analytics suggests users would benefit by selecting a target score and receiving actionable recommendations on how to achieve their ideal credit score.

Solution

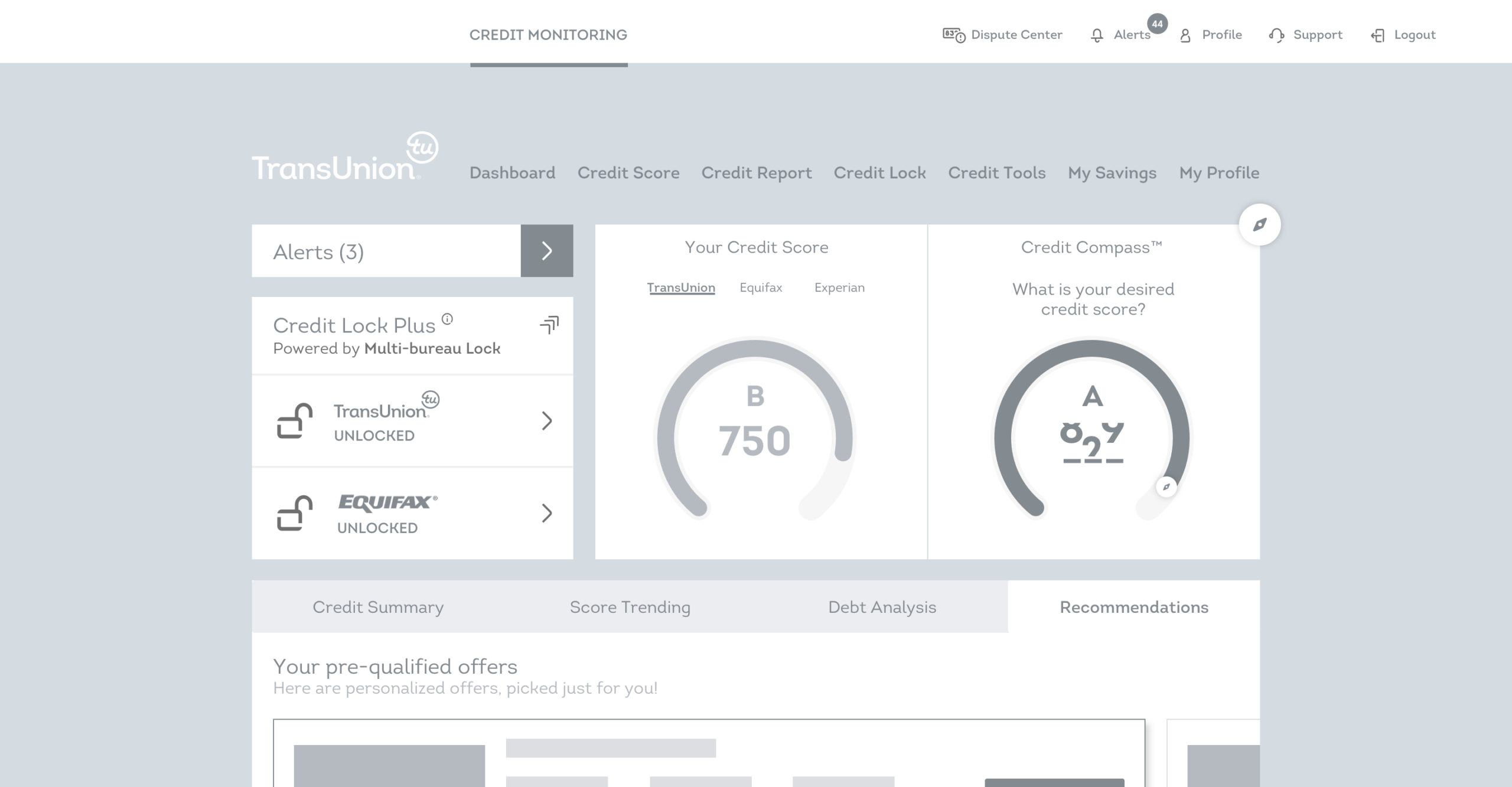

Introduce an interactive feature that can be used across TransUnion’s premium product to enhance engagement, educate users, increase average session times & retention as well as additional offer opportunities for our partners.

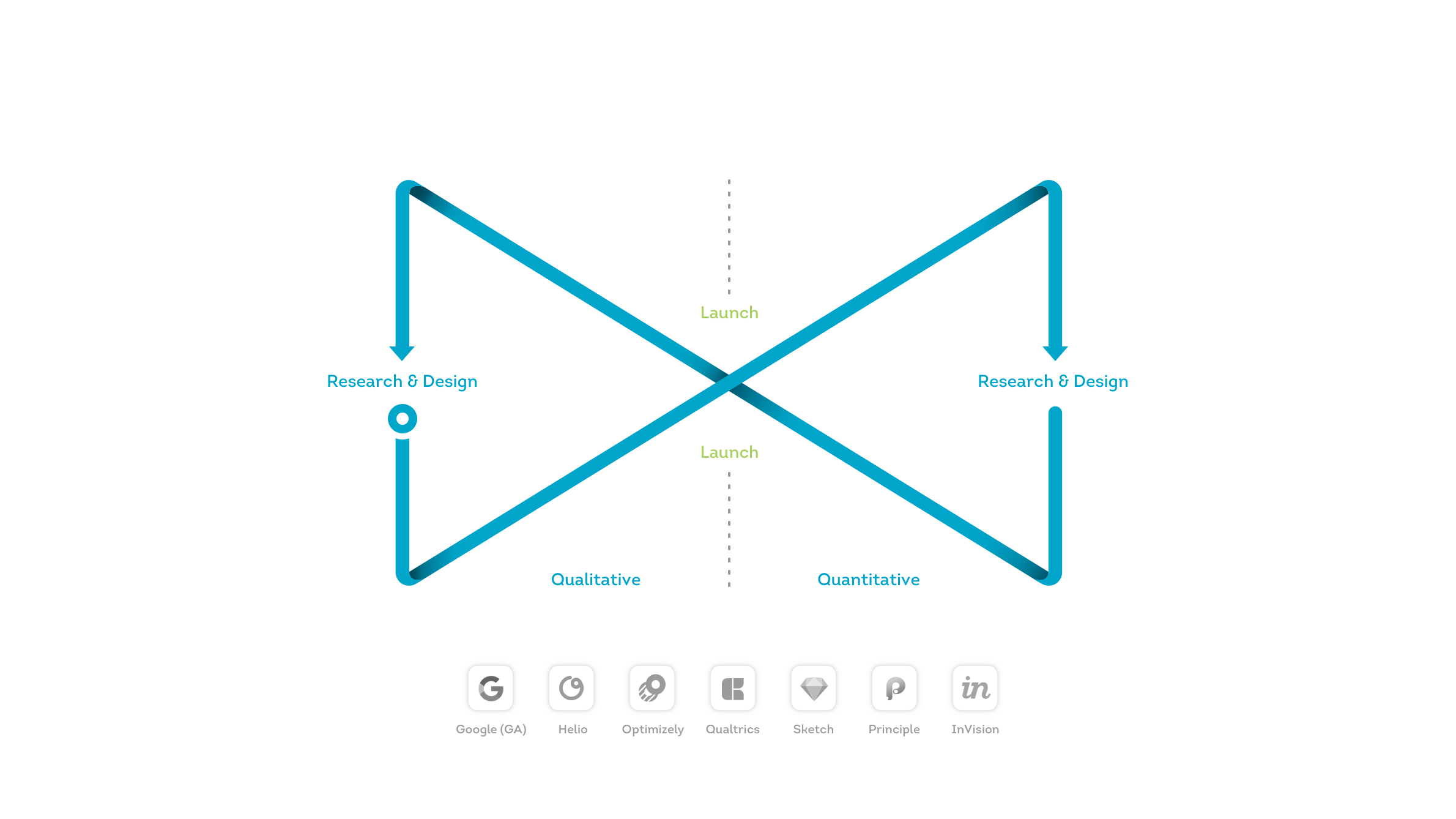

Process

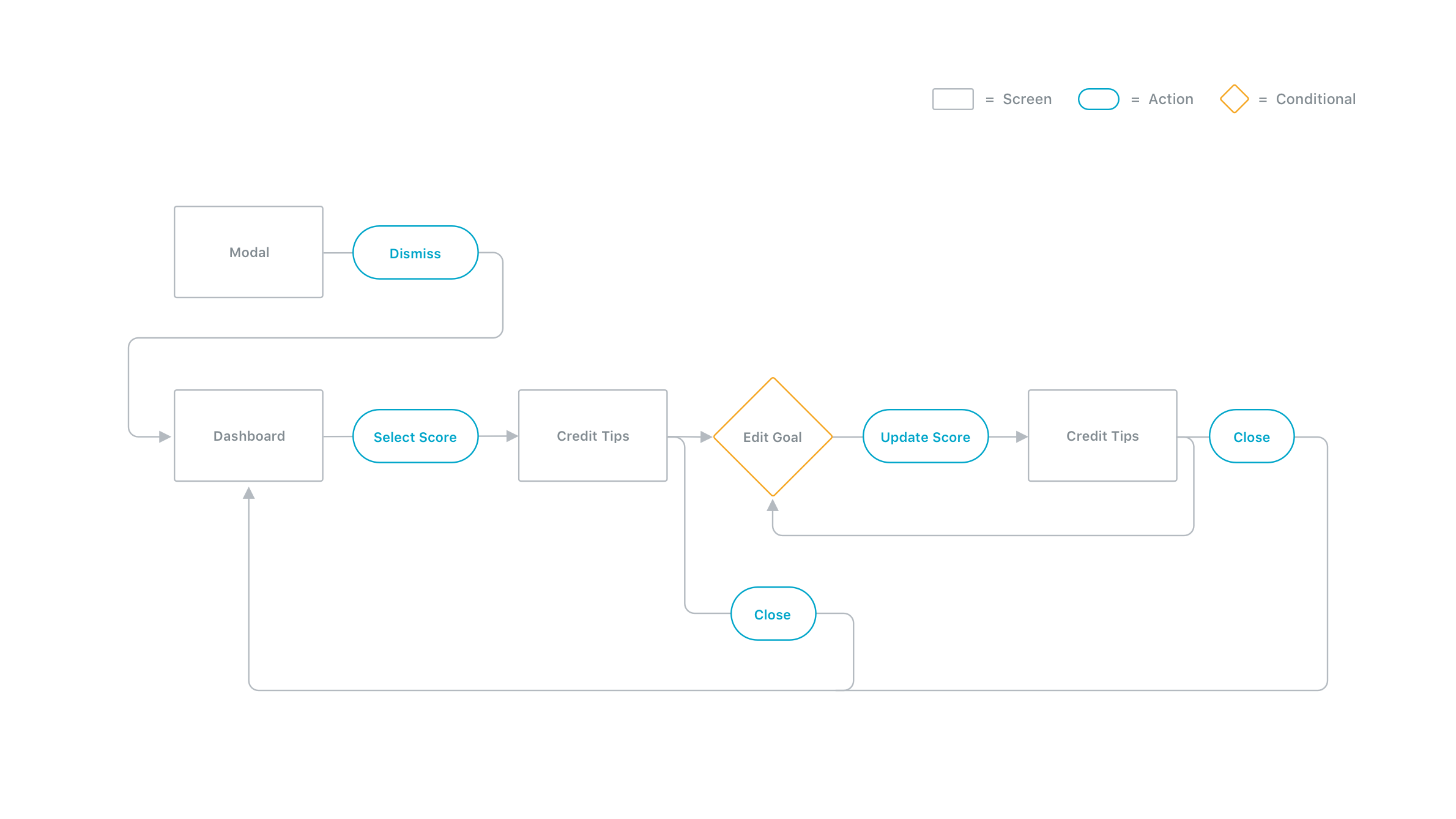

Using our internal iterative design process, we began by first taking inventory of our premium product and its features. We did this through observations made from our quantitative data based on the products current UX patterns. Next, we asked our customers directly about our new feature through user surveys using Helio by Zurb to inform our design strategy towards introducing a new scalable and agnostic UX feature.

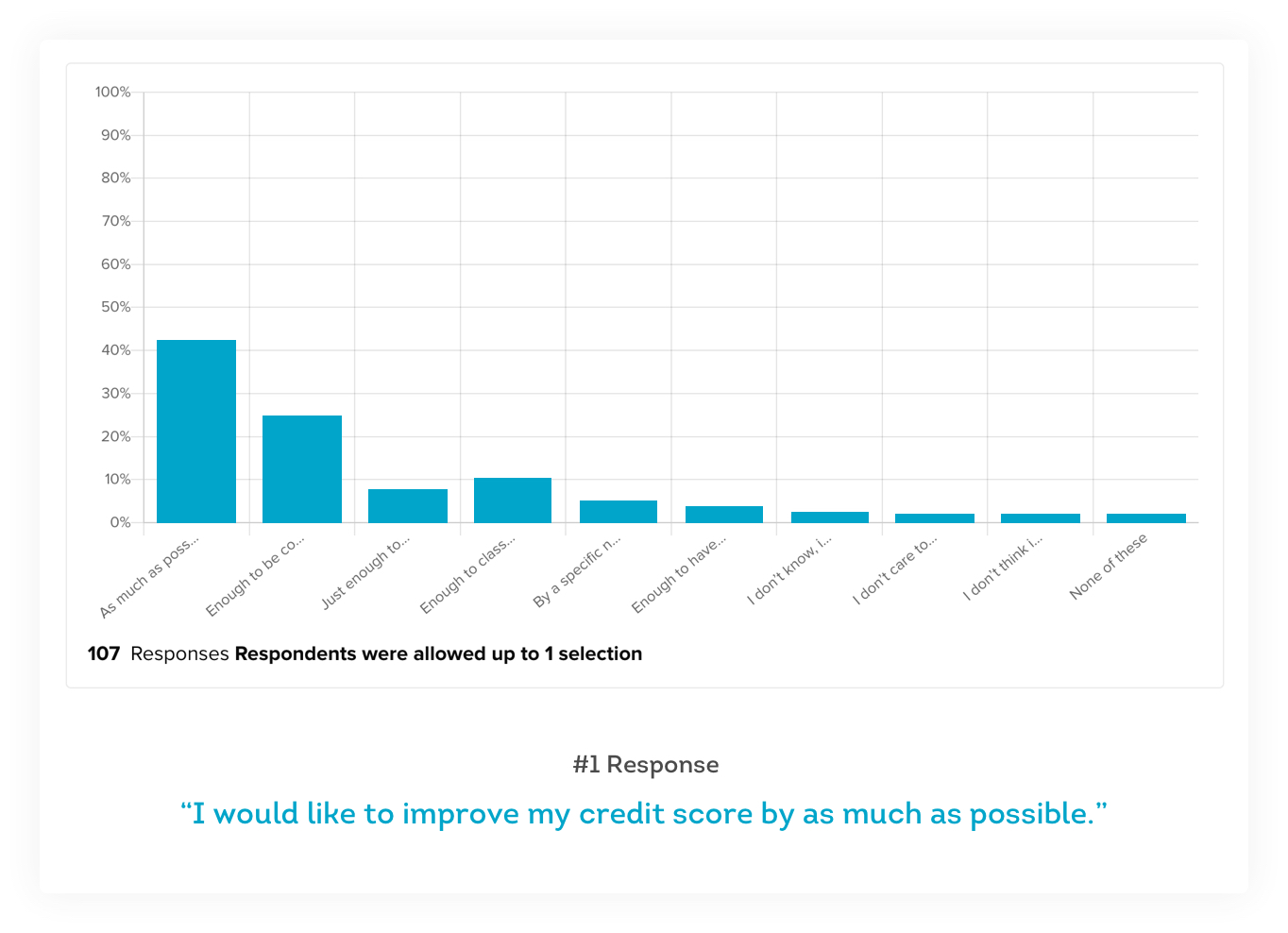

Survey Question:

“If you were asked how much you wanted to improve your credit score by what would your response be?”

Observation:

Majority of consumers crave control when it comes to their credit health and want to obtain the highest score possible. This is also driven by life events.

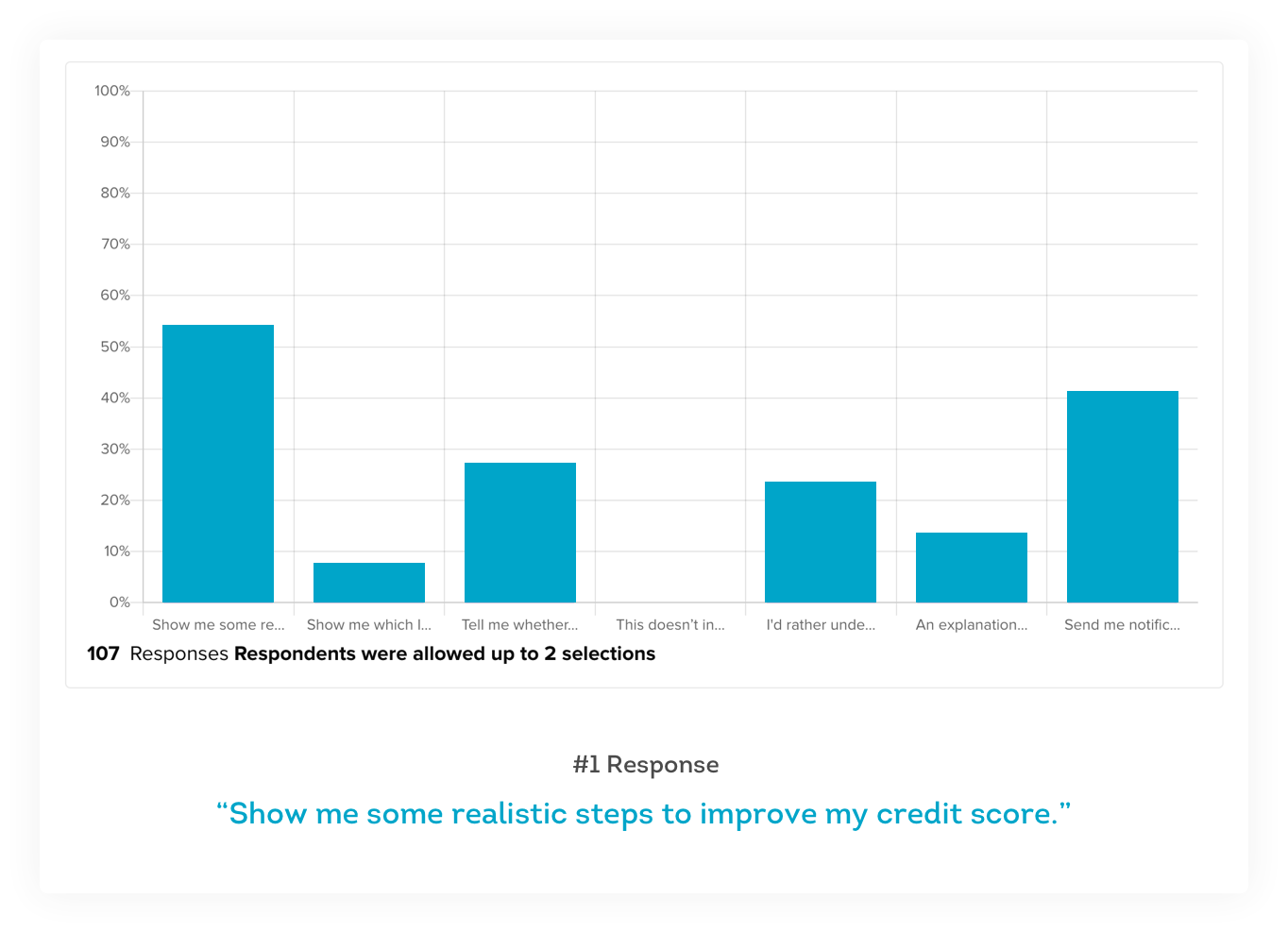

Survey Question:

“If you had a credit coach and asked her how to achieve your desired credit score, which of the following statements best describes the question you might ask her if she could provide you with a list of recommendations?”

Observation:

Users want to receive personalized credit tips that they can initiate immediately. Users also would like to be notified when changes to their score occur.

Survey Question:

“If you wanted to find out how to improve your score, what would you interact with first?”

Observation:

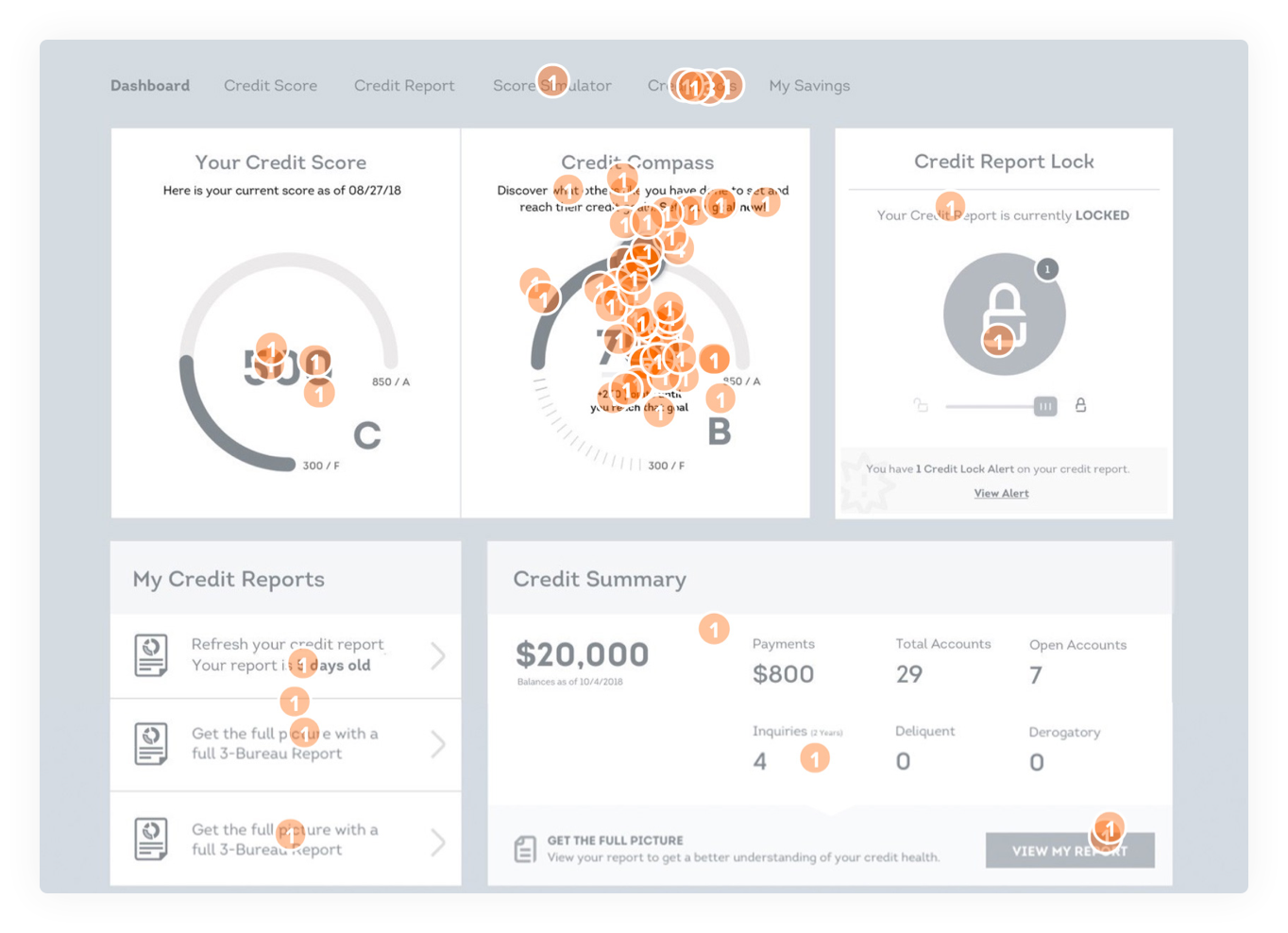

Without any previous education or onboarding around CreditCompass, the majority of users seem to navigate to the appropriate area right of their score.

Design Solution

After gathering qualitative data through user surveys and testing, we defined a direction that we felt both puts the users needs front and center as well as solving the business needs through a simple and intuitive design pattern that can be scaled to other components across the site and app.

Business Impact

After gathering quantitative data through live optimizely test as well as Google Analytics, we were able to define some key business metrics that were positively impacted by our design solution. Once CreditCompass was launched, initital data pointed to increased user engagement, increase in average usertime and an overall improvment in customer retention across our premium product. Our overall user approval rating came in at 74%.

Discover More Projects

Alexa TogetherMobile App

NomNomSaaS, Mobile, Responsive Web

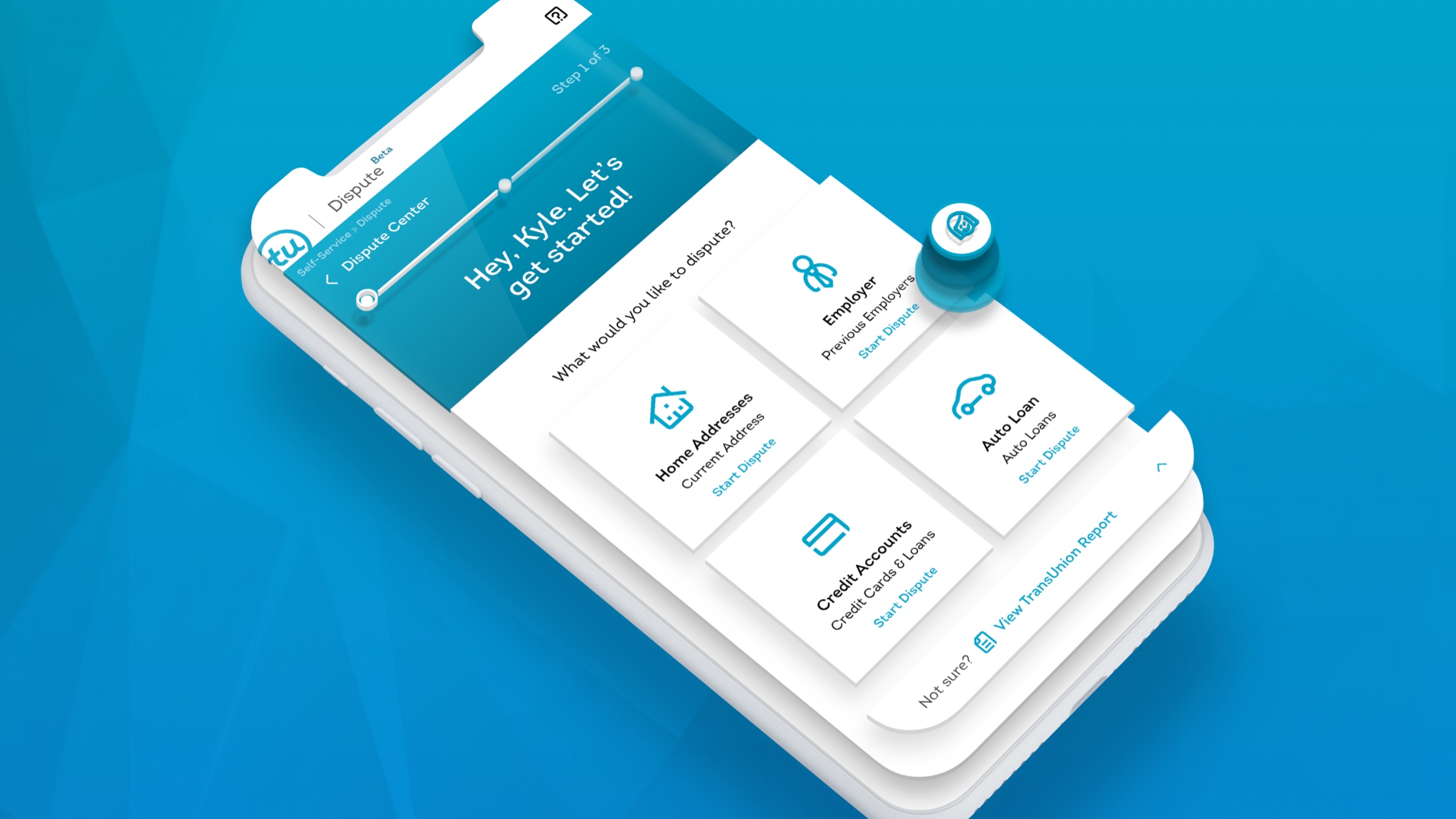

MyTransUnion - DisputeMobile App, Responsive Web

Live your best user story.